Page 62 - RLI February 2019

P. 62

GROUNDS FOR he retail property sector has been a major interested in international brands, but this is changing. The

South African consumers have not always been

focus for development activity within Africa

relatively small size of the middle class means brands have

over the last decade, causing the shopping mall

OPTIMISM Tconcept to take root in an increasingly wide to present themselves as more aspirational than they may

range of major African cities.

be in their home market.

According to Knight Frank’s Africa Report 2017/18,

The major retail chains in South Africa have enormous

development has been driven by the growth of the

terms to suppliers who are generally required to deliver products

continent’s consumer markets and the expansion of purchasing power and are in a position to dictate their buying

domestic and international retailers, particularly the to central depots or warehouses, where products are then

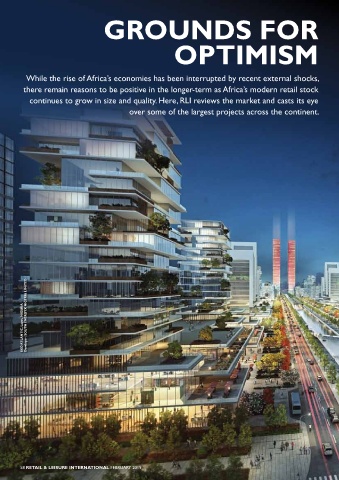

While the rise of Africa’s economies has been interrupted by recent external shocks, leading South African supermarket chains such as Shoprite, distributed to supermarkets and retail outlet stores nationally.

It is possible to enter the South African retail market

there remain reasons to be positive in the longer-term as Africa’s modern retail stock Pick n Pay and Game. direct, though many also franchise and enter via

South Africa is by far the largest and most mature retail

continues to grow in size and quality. Here, RLI reviews the market and casts its eye market in the Sub- Saharan region, with approximately concessions/shop-in-shops.

23 million square metres of shopping centre floor space,

Outside of South Africa, the Kenyan capital Nairobi

over some of the largest projects across the continent. compared with only about three million square metres in has the greatest volume of modern retail floor space in

the whole of the rest of Sub-Saharan Africa. Sub-Saharan Africa, and it continues to be a development

Research from Cushman & Wakefield’s Global Cities hotspot. As the sector grows and competition between

Retail Guide highlights that development in South Africa, retail schemes intensifies, developers will seek to

with a population of some 55.5 million people, is almost as differentiate their malls by offering access to international

extensive as in the UK or France. brands, leisure facilities and upscale consumer experiences.

EKO ATLANTIC, Lagos, NIGERIA Developer: SOUTH ENERGYX NIGERIA LIMITED

AFRICA

58 RETAIL & LEISURE INTERNATIONAL FEBRUARY 2019 FEBRUARY 2019 RETAIL & LEISURE INTERNATIONAL 59