Page 23 - April 2020

P. 23

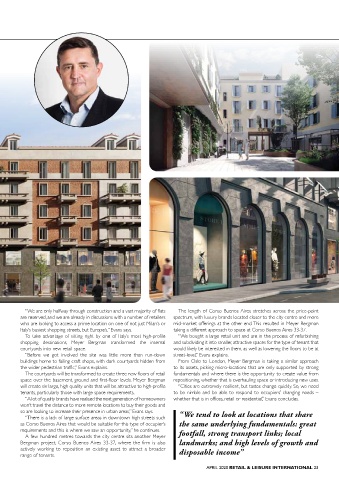

COVER STORY | MEYER BERGMAN

Value In Creation

By focusing on the key fundamentals at a micro-location level, curating

the right mix of uses and occupiers and taking a proactive approach to asset

management, Meyer Bergman has created value at one of Italy’s premier

retail destinations. Here, RLI speaks with Peter Evans, Vice President at

Meyer Bergman to learn more about one of the company’s key projects.

ith Milan sitting alongside London, Paris underground railway station, and is just a stone’s throw “We are only halfway through construction and a vast majority of flats The length of Corso Buenos Aires stretches across the price-point

and New York as one of the world’s away from Milan Central station – a key entry point for are reserved, and we are already in discussions with a number of retailers spectrum, with luxury brands located closer to the city centre and more

fashion capitals, it is no surprise that one of tourists visiting the city. who are looking to access a prime location on one of not just Milan’s or mid-market offerings at the other end. This resulted in Meyer Bergman

W its best-known streets boasts the highest Milan, the capital of the wealthy Lombardy region, is also Italy’s busiest shopping streets, but Europe’s,” Evans says. taking a different approach to space at Corso Buenos Aires 33-37.

concentration of clothing stores on a single road in Europe. the richest metropolitan area of Italy in terms of GDP per To take advantage of sitting right by one of Italy’s most high-profile “We bought a large retail unit and are in the process of refurbishing

At 1.4km, Corso Buenos Aires is Italy’s longest shopping capita, according to the OECD, helping explain the city’s shopping destinations, Meyer Bergman transformed the internal and subdividing it into smaller, attractive spaces for the type of tenant that

street. High levels of Latin American immigration in the ability to support such a density of retail, including many courtyards into new retail space. would likely be interested in them, as well as lowering the floors to be at

early 20th century led to the avenue being renamed after premium outlets and luxury brands. “Before we got involved the site was little more than run-down street-level,” Evans explains.

the Argentinian capital, and also help explain the names As a vertically integrated investment business, Meyer buildings home to failing craft shops, with dark courtyards hidden from From Oslo to London, Meyer Bergman is taking a similar approach

of a nearby metro station and the street’s main public Bergman’s focus is on creating new landmark destinations the wider pedestrian traffic,” Evans explains. to its assets, picking micro-locations that are only supported by strong

square: Lima and Piazzale Argentina. Today, Corso Buenos through carefully tailored asset management strategies. The The courtyards will be transformed to create three new floors of retail fundamentals and where there is the opportunity to create value from

Aires attracts people from across the globe, drawing over firm has always been focused on sourcing off-market deals space over the basement, ground and first-floor levels. Meyer Bergman repositioning, whether that is overhauling space or introducing new uses.

100,000 visitors a day on average. and has advised three closed-ended, value-add real estate will create six large, high quality units that will be attractive to high-profile “Cities are extremely resilient, but tastes change quickly. So, we need

It was these fundamentals – proximity to transport links funds and a number of co-investments to date, with a total tenants, particularly those with large space requirements. to be nimble and be able to respond to occupiers’ changing needs –

and high footfall – that encouraged Meyer Bergman, one of €7.5bn of assets on behalf of global institutional investors. “A lot of quality brands have realised the next generation of homeowners whether that is in offices, retail or residential,” Evans concludes.

of Europe’s leading private equity real estate managers, to One such example of this nimble approach is Meyer won’t travel the distance to more remote locations to buy their goods and

first examine investment opportunities there. Bergman’s €250M Corti Segrete and Corso Buenos Aires so are looking to increase their presence in urban areas,” Evans says. “We tend to look at locations that share

“We tend to look at locations that share the same 59 project, where the firm has created 166 apartments “There is a lack of large surface areas in downtown high streets such

underlying fundamentals: great footfall, strong transport above nearly 8,200sq m of retail space across four as Corso Buenos Aires that would be suitable for this type of occupier’s the same underlying fundamentals: great

links; local landmarks; and high levels of growth and interwar-era buildings. requirements and this is where we saw an opportunity,” he continues. footfall, strong transport links; local

disposable income,” explains Peter Evans, Vice President Backed by a €117.5M loan from M&G Investments, A few hundred metres towards the city centre sits another Meyer

at Meyer Bergman. Meyer Bergman has successfully repositioned what was a Bergman project, Corso Buenos Aires 33-37, where the firm is also landmarks; and high levels of growth and

Corso Buenos Aires is home to no less than three derelict, failed retail scheme and outdated residential into actively working to reposition an existing asset to attract a broader disposable income”

metro stops, as well as the Milano Porta Venezia an attractive mixed-use development. range of tenants.

22 RETAIL & LEISURE INTERNATIONAL APRIL 2020 APRIL 2020 RETAIL & LEISURE INTERNATIONAL 23