Page 52 - #182 June 2023

P. 52

VOYAGER - ICONIC RETAIL DESTINATIONS

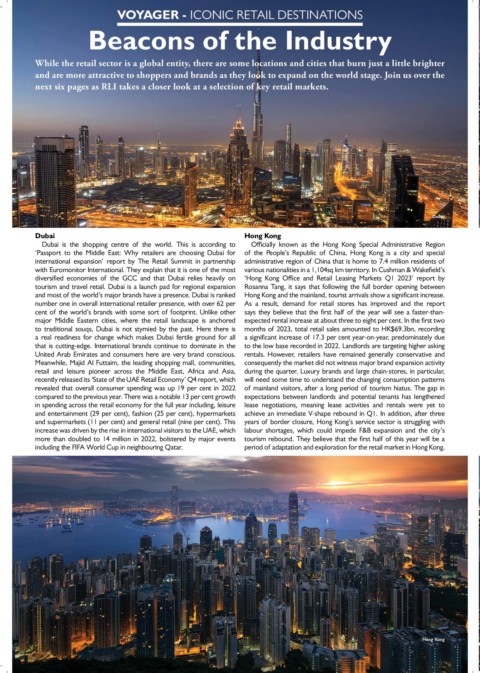

Beacons of the Industry

While the retail sector is a global entity, there are some locations and cities that burn just a little brighter

and are more attractive to shoppers and brands as they look to expand on the world stage. Join us over the

next six pages as RLI takes a closer look at a selection of key retail markets.

Dubai

Dubai Hong Kong

Dubai is the shopping centre of the world. This is according to Officially known as the Hong Kong Special Administrative Region

‘Passport to the Middle East: Why retailers are choosing Dubai for of the People’s Republic of China, Hong Kong is a city and special

international expansion’ report by The Retail Summit in partnership administrative region of China that is home to 7.4 million residents of

with Euromonitor International. They explain that it is one of the most various nationalities in a 1,104sq km territory. In Cushman & Wakefield’s

diversified economies of the GCC and that Dubai relies heavily on ‘Hong Kong Office and Retail Leasing Markets Q1 2023’ report by

tourism and travel retail. Dubai is a launch pad for regional expansion Rosanna Tang, it says that following the full border opening between

and most of the world’s major brands have a presence. Dubai is ranked Hong Kong and the mainland, tourist arrivals show a significant increase.

number one in overall international retailer presence, with over 62 per As a result, demand for retail stores has improved and the report

cent of the world’s brands with some sort of footprint. Unlike other says they believe that the first half of the year will see a faster-than-

major Middle Eastern cities, where the retail landscape is anchored expected rental increase at about three to eight per cent. In the first two

to traditional souqs, Dubai is not stymied by the past. Here there is months of 2023, total retail sales amounted to HK$69.3bn, recording

a real readiness for change which makes Dubai fertile ground for all a significant increase of 17.3 per cent year-on-year, predominately due

that is cutting-edge. International brands continue to dominate in the to the low base recorded in 2022. Landlords are targeting higher asking

United Arab Emirates and consumers here are very brand conscious. rentals. However, retailers have remained generally conservative and

Meanwhile, Majid Al Futtaim, the leading shopping mall, communities, consequently the market did not witness major brand expansion activity

retail and leisure pioneer across the Middle East, Africa and Asia, during the quarter. Luxury brands and large chain-stores, in particular,

recently released its ‘State of the UAE Retail Economy’ Q4 report, which will need some time to understand the changing consumption patterns

revealed that overall consumer spending was up 19 per cent in 2022 of mainland visitors, after a long period of tourism hiatus. The gap in

compared to the previous year. There was a notable 13 per cent growth expectations between landlords and potential tenants has lengthened

in spending across the retail economy for the full year including, leisure lease negotiations, meaning lease activities and rentals were yet to

and entertainment (29 per cent), fashion (25 per cent), hypermarkets achieve an immediate V-shape rebound in Q1. In addition, after three

and supermarkets (11 per cent) and general retail (nine per cent). This years of border closure, Hong Kong’s service sector is struggling with

increase was driven by the rise in international visitors to the UAE, which labour shortages, which could impede F&B expansion and the city’s

more than doubled to 14 million in 2022, bolstered by major events tourism rebound. They believe that the first half of this year will be a

including the FIFA World Cup in neighbouring Qatar. period of adaptation and exploration for the retail market in Hong Kong.

Hong Kong