Page 57 - #182 June 2023

P. 57

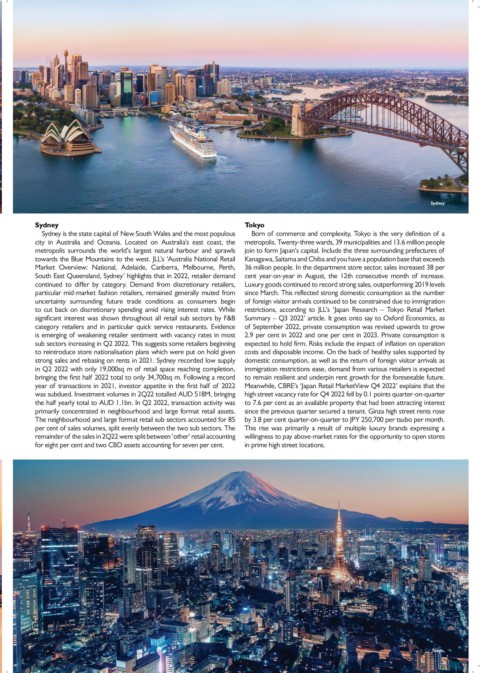

Sydney

Sydney Tokyo

Sydney is the state capital of New South Wales and the most populous Born of commerce and complexity, Tokyo is the very definition of a

city in Australia and Oceania. Located on Australia’s east coast, the metropolis. Twenty-three wards, 39 municipalities and 13.6 million people

metropolis surrounds the world’s largest natural harbour and sprawls join to form Japan’s capital. Include the three surrounding prefectures of

towards the Blue Mountains to the west. JLL’s ‘Australia National Retail Kanagawa, Saitama and Chiba and you have a population base that exceeds

Market Overview: National, Adelaide, Canberra, Melbourne, Perth, 36 million people. In the department store sector, sales increased 38 per

South East Queensland, Sydney’ highlights that in 2022, retailer demand cent year-on-year in August, the 12th consecutive month of increase.

continued to differ by category. Demand from discretionary retailers, Luxury goods continued to record strong sales, outperforming 2019 levels

particular mid-market fashion retailers, remained generally muted from since March. This reflected strong domestic consumption as the number

uncertainty surrounding future trade conditions as consumers begin of foreign visitor arrivals continued to be constrained due to immigration

to cut back on discretionary spending amid rising interest rates. While restrictions, according to JLL’s ‘Japan Research – Tokyo Retail Market

significant interest was shown throughout all retail sub sectors by F&B Summary – Q3 2022’ article. It goes onto say to Oxford Economics, as

category retailers and in particular quick service restaurants. Evidence of September 2022, private consumption was revised upwards to grow

is emerging of weakening retailer sentiment with vacancy rates in most 2.9 per cent in 2022 and one per cent in 2023. Private consumption is

sub sectors increasing in Q2 2022. This suggests some retailers beginning expected to hold firm. Risks include the impact of inflation on operation

to reintroduce store nationalisation plans which were put on hold given costs and disposable income. On the back of healthy sales supported by

strong sales and rebasing on rents in 2021. Sydney recorded low supply domestic consumption, as well as the return of foreign visitor arrivals as

in Q2 2022 with only 19,000sq m of retail space reaching completion, immigration restrictions ease, demand from various retailers is expected

bringing the first half 2022 total to only 34,700sq m. Following a record to remain resilient and underpin rent growth for the foreseeable future.

year of transactions in 2021, investor appetite in the first half of 2022 Meanwhile, CBRE’s ‘Japan Retail MarketView Q4 2022’ explains that the

was subdued. Investment volumes in 2Q22 totalled AUD 518M, bringing high street vacancy rate for Q4 2022 fell by 0.1 points quarter-on-quarter

the half yearly total to AUD 1.1bn. In Q2 2022, transaction activity was to 7.6 per cent as an available property that had been attracting interest

primarily concentrated in neighbourhood and large format retail assets. since the previous quarter secured a tenant. Ginza high street rents rose

The neighbourhood and large format retail sub sectors accounted for 85 by 3.8 per cent quarter-on-quarter to JPY 250,700 per tsubo per month.

per cent of sales volumes, split evenly between the two sub sectors. The This rise was primarily a result of multiple luxury brands expressing a

remainder of the sales in 2Q22 were split between ‘other’ retail accounting willingness to pay above-market rates for the opportunity to open stores

for eight per cent and two CBD assets accounting for seven per cent. in prime high street locations.

Tokyo,