Page 87 - #200 June/July 2025

P. 87

Palisades Village Revitalisation,

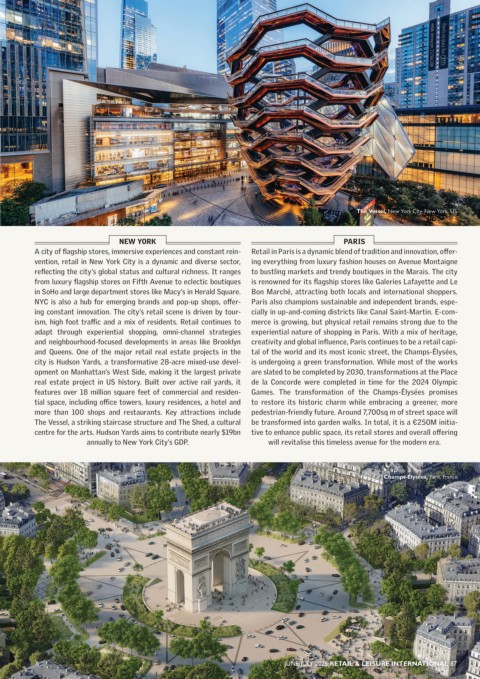

Los Angeles, California, US The Vessel, New York City, New York, US

LOS ANGELES MILAN NEW YORK PARIS

-

Los Angeles boasts a dynamic and diverse retail market driven by its Milan’s retail market remains one of Europe’s most dynamic, driven A city of flagship stores, immersive experiences and constant rein- Retail in Paris is a dynamic blend of tradition and innovation, offer

large population, tourism and affluent consumers. The city is a hub by high tourist footfall and strong local spending. The city blends vention, retail in New York City is a dynamic and diverse sector, ing everything from luxury fashion houses on Avenue Montaigne

for luxury, fashion and lifestyle brands, with strong performance in luxury fashion with emerging concept stores, anchored by prime reflecting the city’s global status and cultural richness. It ranges to bustling markets and trendy boutiques in the Marais. The city

high-street corridors like Rodeo Drive and The Grove. Retail demand is shopping areas like Via Montenapoleone and Corso Vittorio Emanuele from luxury flagship stores on Fifth Avenue to eclectic boutiques is renowned for its flagship stores like Galeries Lafayette and Le

bolstered by entertainment, hospitality and tech sectors. E-commerce II. Demand for flagship spaces remains robust, especially from global in SoHo and large department stores like Macy’s in Herald Square. Bon Marché, attracting both locals and international shoppers.

growth has prompted omni-channel strategies, while experiential retail brands seeking presence in this fashion capital. Retail rents in prime NYC is also a hub for emerging brands and pop-up shops, offer- Paris also champions sustainable and independent brands, espe -

and pop-up stores are reshaping physical spaces. Despite challenges from zones are among Italy’s highest, supported by steady recovery in tour- ing constant innovation. The city’s retail scene is driven by tour- cially in up-and-coming districts like Canal Saint-Martin. E-com -

inflation and shifting consumer behaviour, foot traffic and leasing activity ism and domestic consumption. While e-commerce growth influences ism, high foot traffic and a mix of residents. Retail continues to merce is growing, but physical retail remains strong due to the

are rebounding. Mixed-use developments and revitalised neighbourhoods consumer habits, physical retail continues to thrive, especially in expe- adapt through experiential shopping, omni-channel strategies experiential nature of shopping in Paris. With a mix of heritage,

continue to attract investment, making LA’s retail sector resilient and riential formats. Sustainability and digital integration are key trends and neighbourhood-focused developments in areas like Brooklyn creativity and global influence, Paris continues to be a retail capi-

adaptable. Palisades Village, the open-air shopping and lifestyle destina- shaping future development. Standout projects include Milano Innova- and Queens. One of the major retail real estate projects in the tal of the world and its most iconic street, the Champs-Élysées,

tion in Pacific Palisades, is slated to reopen in 2026, with early to mid-year tion District (MIND), an ideal urban district for building the city of the city is Hudson Yards, a transformative 28-acre mixed-use devel- is undergoing a green transformation. While most of the works

targeted for its return. The relaunch will feature returning tenants, new future, where collective well-being; sustainability and social inclusion opment on Manhattan’s West Side, making it the largest private are slated to be completed by 2030, transformations at the Place

offerings and a renewed focus on community-centred spaces. Among the are the foundations. Another key location is the Porta Romana Olym- real estate project in US history. Built over active rail yards, it de la Concorde were completed in time for the 2024 Olympic

notable returns is luxury fashion retailer elysewalker, a cornerstone of pic Village, which will consist of a large Central Park, urban continuity, features over 18 million square feet of commercial and residen - Games. The transformation of the Champs-Élysées promises

the Palisades retail scene. The brand will relocate and reopen its flag - pedestrian and cycle connections, an eco-zone, public squares and the tial space, including office towers, luxury residences, a hotel and to restore its historic charm while embracing a greener, more

ship store within the revamped Palisades Village, reaffirming its long- Suspended Forest: these are the defining elements of the Parco Romana more than 100 shops and restaurants. Key attractions include pedestrian-friendly future. Around 7,700sq m of street space will

standing ties to the neighbourhood. In addition to legacy retail, a new Masterplan, which will see nature and the city united in an innovative The Vessel, a striking staircase structure and The Shed, a cultural be transformed into garden walks. In total, it is a €250M initia -

dining concept is expected to be unveiled in the coming months, adding and sustainable network of public spaces. The site will be converted centre for the arts. Hudson Yards aims to contribute nearly $19bn tive to enhance public space, its retail stores and overall offering

to the reimagined village experience. into student housing and retail space after Milano-Cortina 2026. annually to New York City’s GDP. will revitalise this timeless avenue for the modern era.

Porta Romana Olympic Village, Milan, Italy Champs-Élysées, Paris, France

86 RETAIL & LEISURE INTERNATIONAL JUNE/JULY 2025 JUNE/JULY 2025 RETAIL & LEISURE INTERNATIONAL 87